Additional information

| Demonstration | Our expert team look forward to walking you through how BDO QuickTrip can manage and track your business travellers. |

|---|

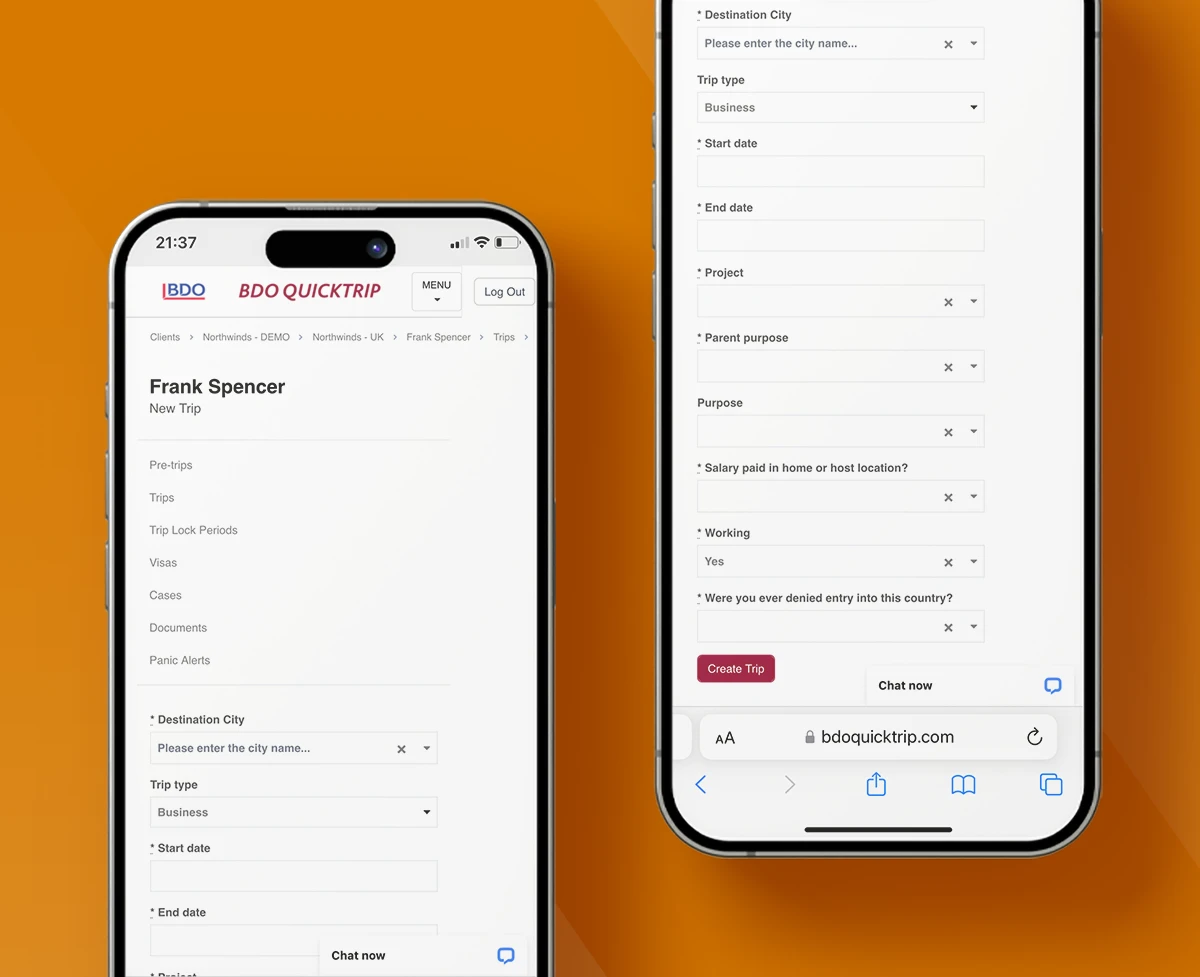

BDO QuickTrip is a mobile-ready online platform to help HR and finance teams manage the increasing tax and immigration challenges for their growing business traveller communities.

| Demonstration | Our expert team look forward to walking you through how BDO QuickTrip can manage and track your business travellers. |

|---|

Need help with your order?

Check our FAQs page or get in touch.

Use BDO QuickTrip to track employee cross-border movements from existing data sources (i.e. travel management, expense or timesheet data) or manually through a 30 second employee questionnaire, monitor your employees working time spent in overseas locations and manage associated compliance risks.

QuickTrip provides a complete end-to-end service, from alerts for compliance risks through to form submission, receipt and monitoring.

Keep track of your business travellers through interactive dashboards and produce bespoke reports at the click of a button. Efficiently manage any compliance obligations that could arise for both the traveller and your business.

Our technology plus your data with our BDO insight provides data analytics potential across a range of use cases i.e. duty of care, ESG and DE&I to name a few.

Designed to take the stress out of managing international tax affairs and reduce HR complexity, BDO QuickTrip puts you in control and provides you with experts in over 160 countries.

Best Employment Tax Team

Our Cost Projection Tool provides hypothetical cost estimates, helping to ensure you get the most value from your global expatriate assignments.

Manage, organise and execute tax program deliverables for your global workforce and their assignments. Automation, collaboration and task tracking means you can take quicker actions and make smarter decisions, and get maximum value and efficiency from your resources.

Manage your global tax liabilities for incentive and equity-based compensation, accounting for the tax attributes of the recipient and their location.

Our Employee Relocation training is applicable to anyone who is involved in the tax, social security and payroll processes related to bringing an overseas employee into the UK.